A Beginner’s Guide to The 5 Steps of Funding a SaaS Startup

As a business owner, you have to wear a lot of hats. You need to be across every significant aspect of business operations. The earlier posts in our dedicated SaaS series have touched on some of the main ones. From promoting your site to getting leads on social media, we hope we’ve given you a few helpful insights.

Book a Consultation

One area we haven’t yet covered, though, is that of financing. To scale your company and turn it into a success, you need funding at every step of the way. Getting that necessary financing is far from straightforward. You need to know where you can turn and when to get the cash injections that will take your business forward.

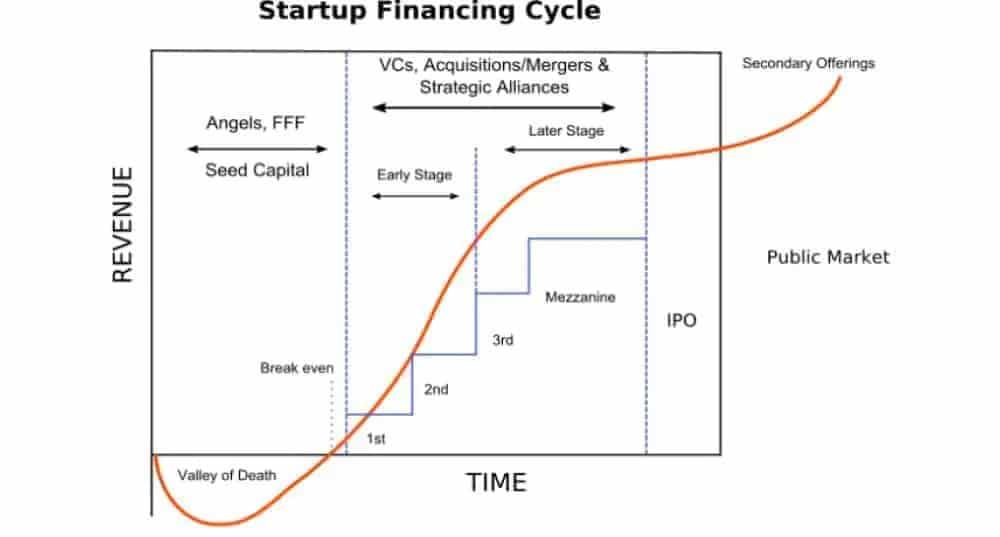

That’s where this beginner’s guide comes in. It will talk you through each step of what may at first seem to be a tortuously complex startup funding process. Read on, and you’ll learn about the following five principal startup funding stages:

- Pre-seed funding

- Seed funding

- Series A-E funding

- Mezzanine financing & bridge loans

- Initial public offering (IPO)

We’re going to explain what each of the startup funding stages entails. You’ll learn the characteristics of businesses as they enter each stage. You’ll also find out where best to seek finance at each different step of the process. If you need to learn all about funding your firm through its growth and development, this guide is for you.

Pre-Seed Funding

Some guides to startup funding neglect to mention pre-seed funding. This first startup funding stage gets overlooked as it occurs so early in a business’s lifecycle. In many ways, however, that also makes it one of the most crucial parts of the entire financing process.

Pre-seed funding is the finance that startups use to get off the ground. It’s the money that allows a founder of a business to get the ball rolling. In the case of a SaaS business, that may mean developing a proof of concept of the ultimate product. If you can get enough early finance, you may be able to create a beta version of your software.

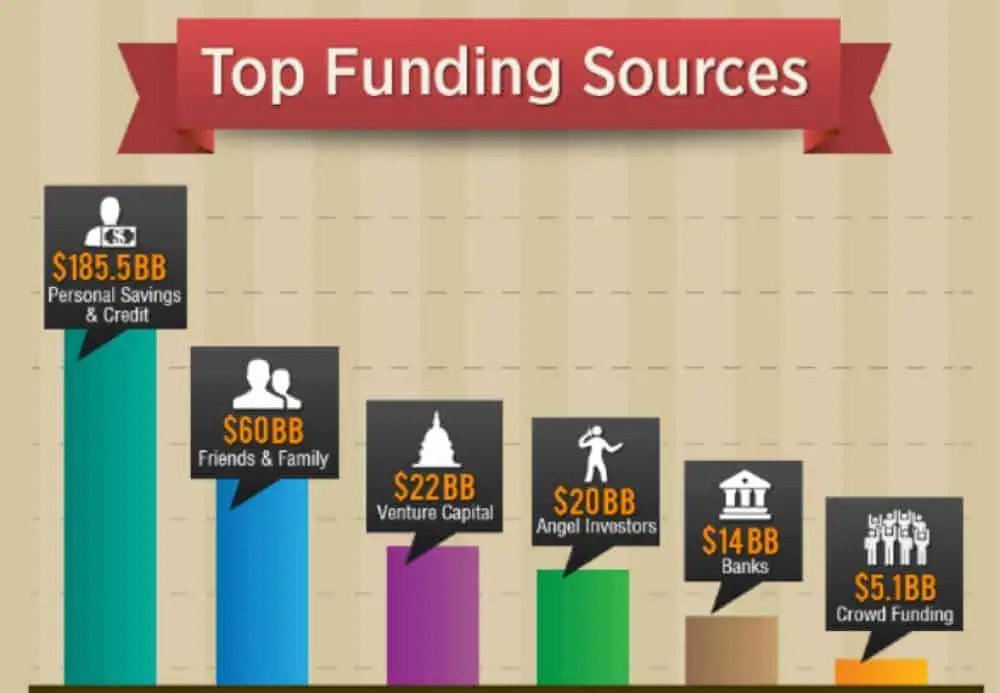

Startups at this funding stage are very much in their infancies. As such, venture capitalists or other equity finance sources aren’t open to them. There are a few different options for getting pre-seed funding, however.

Most startup founders have to rely on their own resources for pre-seed funding. Dipping into savings, re-mortgaging homes, and taking on second jobs are all common routes for entrepreneurs. This reliance on your own money to fund a business is often called bootstrapping. As per the old saying of ‘pulling yourself up by your bootstraps’.

(https://www.fundable.com/learn/resources/guides/startup/funding-your-startup)

There are a few other options available for raising cash at this earliest funding stages. Lots of business founders look to friends and family for their initial investment.

Your loved ones won’t need as much proof of the viability of your young firm to commit their investment. They will also likely agree to more favourable repayment terms. You should always take care, though, when seeking financing from relatives or friends. Problems down the road can lead to upset and disagreement.

Certain independent investors may also consider providing pre-seed funding. Some wealthy individuals and specialist funds actively invest in very young startups. Those financers get called ‘Angel Investors’, as their cash is such a godsend to startups.

Seed Funding

Continuing the botanical theme, the second of the five major startup funding stages is the seed funding stage. This investment is what truly gets a startup growing. Seed funding is vital to any business’s success, whatever the field.

According to Small Biz Trends, 29% of startups fail because they run out of cash. Most of those failures occur in the early months and years of a firm’s operation. That means that the businesses falter as they don’t get their seed funding right.

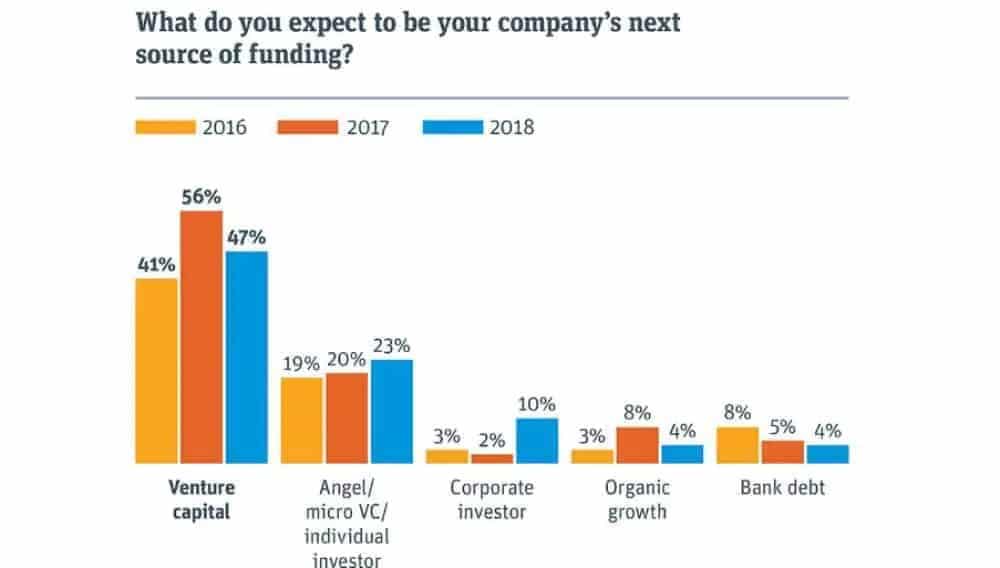

(https://www.svb.com/startup-outlook-report/uk)

Finance raised at this stage of a firm’s development starts to turn the ideas behind a startup into reality. It’s this cash that gets used to fund a product launch or to seek market research. In some cases, too, seed funding can finance the hiring of staff to move a firm forward.

The seed funding stage is the first one in which equity financing is a realistic option for most firms.

A Quick Refresher; Equity Financing

Equity financing is an investment in a business, provided in exchange for a stake in the company. Investors receive shares in the company in return for their investment. Those shares increase and decrease in value with the overall valuation of the business.

If you do go down the equity finance route for seed funding, small venture capital funds are your best bet. There are lots of specialist seed funds, like Passion Capital and Seed Camp. They work with smaller businesses to help them grow and develop.

Angel investors are also a rich source for seed funding. It’s often easier for them to assess the viability of a business once it’s reached this stage of development. More ‘angels’, then, will take part in the seed than the pre-seed funding stage.

It’s still possible, too, for business owners or their friends and family to account for a firm’s seed funding. Often, though, the extent of financing needed at this stage is beyond the budget of all but pro investors.

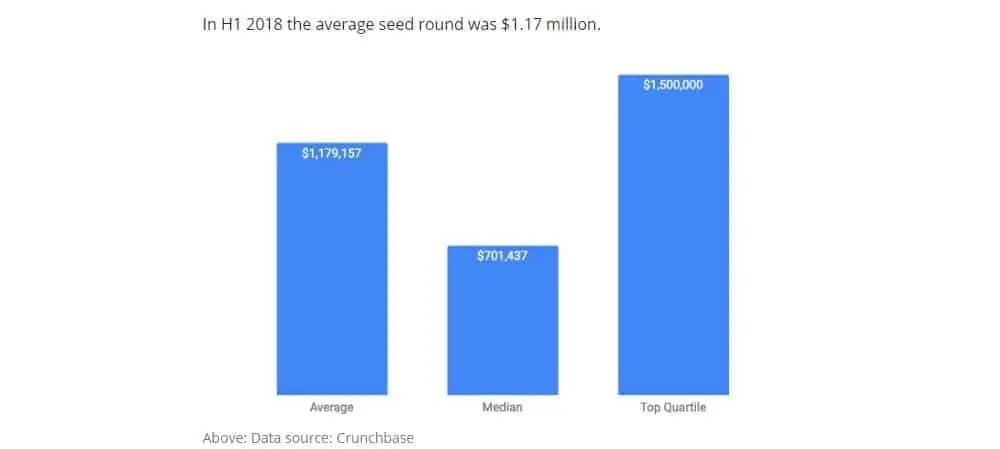

(https://venturebeat.com/2018/08/22/the-european-seed-landscape-2018-so-far/)

The seed funding stage is the final step of the financing process for many small businesses. Some owners fail to raise enough cash and see their businesses fold. Others raise enough money at this stage to forgo any further search for financing. That may be because their business won’t ever grow large enough to need more investment. It could also be because the organic growth of the company will supply all the required cash.

Series A-E Funding

The principal, middle portion of the startup funding process comprises five different ‘series’. Those series are all given a letter designation from A-E. As a business moves from one round to the next, it looks to raise more money and increases its valuation.

Series A

Startups that do go through the seed funding step will begin to see some commercial traction. Their services will be picking up users, and monthly revenue will be steadily growing. By tracking key performance indicators (KPIs), you can spot when you may be ready for Series A funding. Such KPIs can include customer numbers or turnover.

Series A is where things get serious when it comes to investors. It’s where the significant venture capital (VC) funds may become interested in your business. It’s not easy, though, for any startup to get those funds to part with their cash.

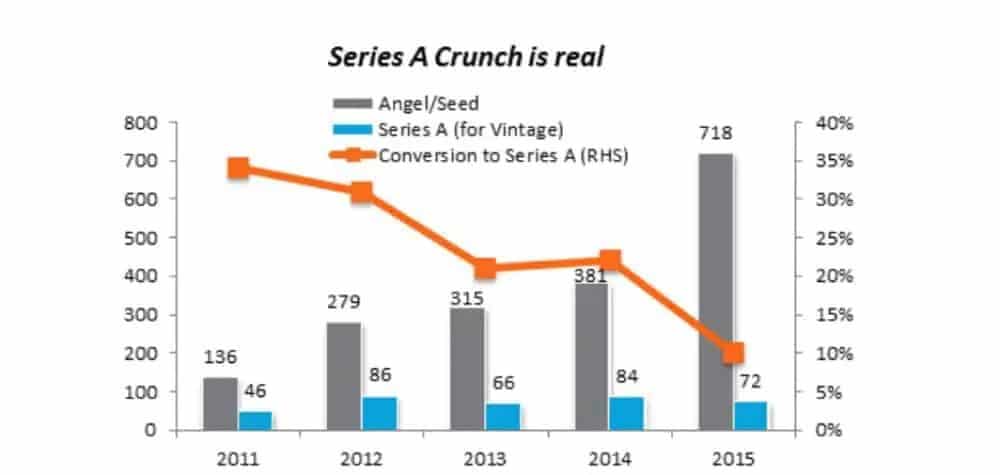

(https://equitycrest.wordpress.com/tag/funding/)

When you’re seeking finance at this stage, you need a whole, accurate, and impressive business plan. A great idea and a few early adopters won’t cut it with serious VC firms. Even with a great business plan and early signs of success, most funds will still turn you down.

Many experts cite the 30-10-2 rule for Series A. That rule states that for every 30 funds that you think may invest, only ten will show actual interest. Of those ten, two may actually commit funds. During Series A, therefore, you must approach investors in bulk to try to raise the finance you need.

Series B

Startups that reach Series B are significant businesses. They’ve captured a considerable user base, and are bringing in high monthly revenues. What their Series B funding is for is to take the firm to a new level. This finance is what they need to make their business work at scale.

In most ways, Series B is similar to the previous funding stage. A lot of the investors involved will be the same. The most successful Series B funding rounds get more cash from the original backers and add new ones.

Series C

If Series B startups are serious businesses, those that reach Series C are veritable goliaths. They’ve tasted significant success and are now on a path to even higher growth. This third main funding round is where the size of investments rises profoundly.

Startups looking for Series C funding are seeking real expansion. The funding is often to help them create new products, move into new markets, or even buy up other smaller firms. In many cases, too, businesses enter the Series C stage to get cash so that they can go international.

By this point, firms are no longer risky propositions for investors. As such, private equity firms, hedge funds, and investment banks all often get involved in Series C.

Series D & E

Series C is the final investment round for many startups. That startup funding stage usually puts a firm in an excellent place to think about an IPO. A business will often only embark on a Series D round and beyond, in exceptional circumstances.

A company may, for instance, need a cash injection to fund a potentially beneficial merger. If they’re not ready to go public, an extra funding round can help them get that finance. On the flip side, if a business has had a tricky spell, they may need further funding just to stay afloat.

(https://startupxplore.com/en/blog/types-startup-investing/)

Even in the above circumstances, many firms don’t turn to new funding series. For finance at this stage, they look instead to different options to carry them through to an IPO.

Mezzanine Financing & Bridge Loans

Any startup that’s moved all the way through its seed and main funding stages is tracking towards going public. By that, we mean that the business will likely soon embark on an IPO to start trading on the stock exchange. To prepare for the final push toward an IPO, firms sometimes need one last influx of finance.

Mezzanine financing is where lots of companies turn for this final cash injection. This type of funding gets its name from the eponymous ‘in-between’ floors. You can find mezzanines in some large buildings, and you’ll see an example in the image below.

The form of financing gets its name because it’s an ‘in-between’ form of funding. It represents a middle way between a traditional loan and typical equity funding.

Cash lent via mezzanine financing is often subject to high interest rates. Lenders also have the option to convert what’s owed into equity in the company at a later date. That may only be if you default on repayment, or it may be after a specified period. The higher interest rate makes mezzanine financing riskier for a startup. It’s purpose, though, is to speed the firm toward exit.

Initial Public Offering (IPO)

An IPO is the last stage of funding any startup goes through. Usually, an IPO is the method by which the business’s founder or owner exits the stage. An IPO is when corporate shares in the company get offered to the public for the first time. The business’s current owners and investors get paid based on their present stake in the firm.

IPOs can be risky for startups and their owners. There’s no way to know for how much a business’s shares will sell. If an IPO goes well, though, current stockholders and investors can enjoy a considerable windfall. As a public company, too, the business can raise more funds in the future via secondary offerings.

Finding Your Way Through The 5 Startup Finding Stages

Passing through the five main startup funding stages is essential for a startup. It’s how business owners can steer their firms successfully from start to finish of their commercial journey. By understanding the stages, you can ID where your business sits and find the best way forward.

Having that grounding in the funding process is vital. Your business must be mature enough to deal with each funding stage fruitfully. If you were to embark on any stage too early, it could be disastrous. Armed with our simple guide, you can avert a catastrophe and take your firm from strength to strength.